Are C-Stores the New QSRs? Insights from the Convenience Experience Report

Convenience stores emerged from the pandemic with lots of demand for their services. Family vacations, in-person events, and daily commutes have started to return, along with the need to refuel and pick up a quick bite to eat.

At the same time, the pandemic changed to the gas and convenience store industry for good. With newly formed behaviors, customer expectations have shifted, especially around how and where they purchase their meals.

Curbside pickup and drive-thru, for example, are more important than ever. 62% of consumers say they'd visit c-stores more often if curbside and drive-thru options were widely available.

That's one finding from the new Convenience Experience Report. It's a study that explores the latest consumer behaviors, preferences, and trends shaping the c-store industry.

Another key finding confirms what many c-store leaders have been hoping for: Nearly 60% of consumers now consider purchasing from a convenience store when stopping for fast food. This is great for the cstore industry, as foodservice now tops 35% of in-store profits, according to the latest National Association of Convenience Stores (NACS) data.

The Convenience Experience Report surveyed more than 1,500 American consumers to gain a deeper understanding of why they choose specific c stores, how they decide which loyalty programs to join, and what motivates them to go from the pump into the store.

The Convenience Experience Report surveyed more than 1,500 American consumers to gain a deeper understanding of why they choose specific c stores, how they decide which loyalty programs to join, and what motivates them to go from the pump into the store.

C-store Loyalty Programs and Mobile Apps

Many convenience stores have introduced mobile apps that allow users to redeem points, order ahead for food, pay for gas, earn special offers and more.

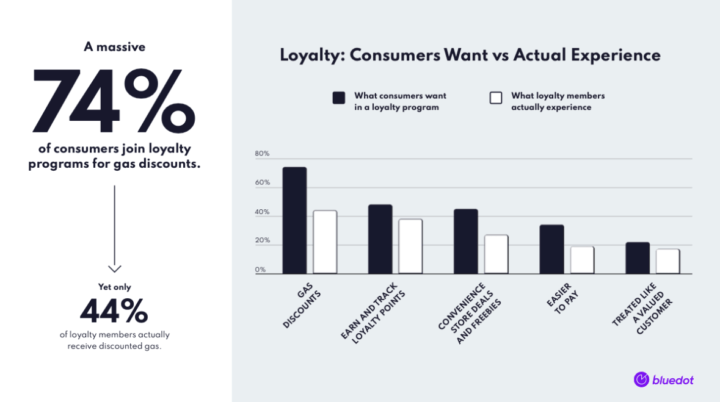

While consumers are eager to download these apps, the surprise and delight experience has fallen short. In reality, many consumers don’t get what they expect from c-store loyalty programs:

This disconnect between expectations and reality might cause them to use the apps less, delete them, or worse, turn to competing c-store apps.

Highlights from the Convenience Experience Report

- There's a significant demand for mobile ordering, drive-thru, and curbside pickup. 62% would visit a c-store more often if drive-thru or curbside pickup was available.

- To win and retain customer loyalty, gas discounts are imperative.

- C-stores and gas stations appear to be losing customers to short lines. 1 in 3 will drive away if there's a single car ahead of them at the pump. Nearly half will walk out of a c-store if one or two people are in line at the register.

Read the full Convenience Experience Report for detailed insights:

Find out how Bluedot helps gas and convenience stores offer better foodservice, increase foot traffic, and drive customer loyalty.