Coffee is Next in Line: Findings from the State of What Feeds Us VII

If the drive-thru line looks a bit too long, coffee shops are next on the list for many diners. That's one of several key findings in the new State of What Feeds Us VII report.

Coffee Drive-Thrus Seen as Faster

The report unveils insights about coffee chains that should concern QSRs.

Long lines at fast-food restaurants tempt nearly 6 in 10 consumers to buy food at a coffee shop instead.

53%

of consumers consider a coffee chain when they're hungry,

even without a coffee purchase.The State of What Feeds Us Vol. 7, 2022

Half of consumers believe coffee chain drive-thrus are faster than quick-serve restaurants.

Coffee chains with drive-thrus are very well positioned to attract QSR customers, and it will be interesting to see how that plays out in the short and long term as more drive-thrus across categories emerge.

Impatience is an ongoing theme in the 7th edition of The State of What Feeds Us.

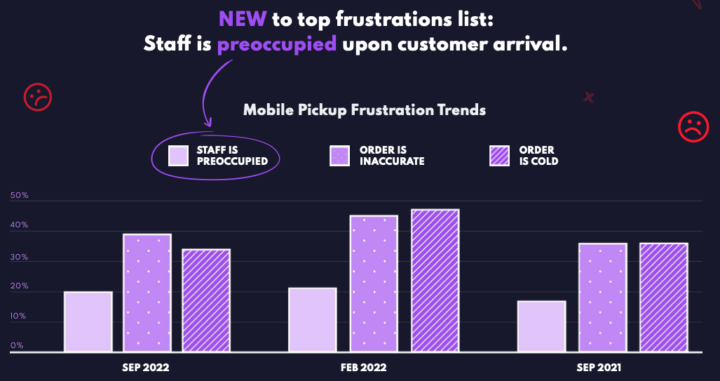

Mobile order pickup is the top frustration, with 1 in 3 consumers unwilling to wait longer than four minutes to receive their food.

Drive-thru visits have remained strong despite the economic downturn, with an uptick from 90% to 91% of respondents visiting a fast-food drive-thru in the past month.

Inflation and Shrinkflation

Price increases have changed consumer habits dramatically, according to the report. In fact, 91% of consumers have noticed price increases at restaurants.

Eighty percent have changed their habits: cutting back on fast food, ordering less expensive items, selecting more from the value menu, or ordering fewer items.

83%

of consumers say they're visiting restaurants less often. The State of What Feeds Us Vol. 7, 2022

At the same time, value menus are gaining popularity. Three quarters of consumers admit they look for discounts more often due to rising menu prices.

Customers are also searching for deals and offers on mobile apps. Two thirds download restaurant apps or loyalty programs to find deals and freebies.

Increasing demand for priced-right menus via value deals, discounts, and offers certainly presents an opportunity for businesses to not only woo customers, but also nurture them into repeat customers, especially through apps and loyalty programs.

Most (77%) have also noticed the effects of shrinkflation, recognizing that they’re paying the same for smaller portion sizes.

Sustainability

For the first time, this report taps into consumer sentiment around sustainability. Importantly, diners care deeply, with 8 in 10 saying they’re more likely to visit restaurants that take steps to compost or donate extra food.

Restaurants can view this as an opportunity, although consumers say they are unwilling to pay more for sustainable dining.

Consumers are also skeptical: three quarters of respondents recognize that restaurants claim to be environmentally conscious, but nearly half (46%) doubt those claims.

Read the full State of What Feeds Us VII for detailed insights into consumer beliefs and behaviors: