How Restaurants Can Improve Their Drive-Thru Experiences

Consumer insights that can help improve the drive-thru experience.

Before the pandemic, drive-thrus had been identified by fast-food restaurant chains as a powerful revenue driver and worthwhile investment - with a minor wait time problem to fix.

In 2018, average drive-thru wait times were up 4% from 2017 and only getting worse. This meant poor customer experiences and a significant loss of potential income by customers discouraged by long lines and / or leaving altogether.

Then 2020 came, and the wait-time issue became colossal.

Whether you’ve personally waited in a drive-thru line for 30+ minutes or had seen news footage of endless stream of cars slowly converging into a single drive-thru lane, it came to no surprise to anyone that drive-thru sales soared, lifted to more than 85% of total sales in 2020 versus two-thirds in 2019. And with it, wait times dragged on.

At first, waiting was forgiven by customers. It was a global pandemic and customers prioritized contactless service and the solace of their favorite comfort food during a stressful time over speed. But as the months went on, customers grew impatient. So much so that today 85% of consumers will consider or outright leave if they perceive a long line (which is anything over 6 mins).

For the restaurants taking modest steps to improve their drive-thru’s speed of service, order accuracy, and personalization in 2018, the events of 2020 reprioritized drive-thru as a key investment for their survival.

The race to improve operational efficiency and speed of service while either maintaining or improving customer experiences has not waned a bit in 2021. More than halfway through the new year, consumers are continuing to prefer drive-thrus but not for the same reasons they did in 2020.

Since COVID, drive-thrus are now generating up to 90% of a restaurant’s revenue. Many restaurants are focused on suggestive selling and menu boards, but they aren’t dealing with speed, even though speed underpins everything in the drive thru. If you have slow service, it doesn’t matter what you upsell or how you personalize the experience, because you won’t have customers.

–Luke Irving, CEO & Founder | Fingermark via QSRmag.com

With an average of 50 million Americans visiting drive-thrus daily and spending $1200 annually, getting the drive-thru right replete with positive customer experience is imperative. To this end, understanding what your customers want out of their drive-thru experience is essential. Knowing where to start in a myriad of complex technologies to enhance your restaurant’s drive-thru can seem overwhelming, especially when moving at such a fast clip. Is the answer to everything digital menu boards or automated loyalty programs? Facial recognition technology or SMS ordering?

Before you can understand what technology makes the best sense for your business, first understand what consumers want most from the drive-thru and which of those demands play to your strengths.

With data spanning over 12 months and 4 studies, the fourth edition of our State of What Feeds Us report surveyed over 1,802 Americans to uncover definitive consumer trends for the restaurant and retail industries. From it, we’ve curated some of the biggest takeaways related to the drive-thru.

Key Consumer Trends on How to Improve Drive-Thru:

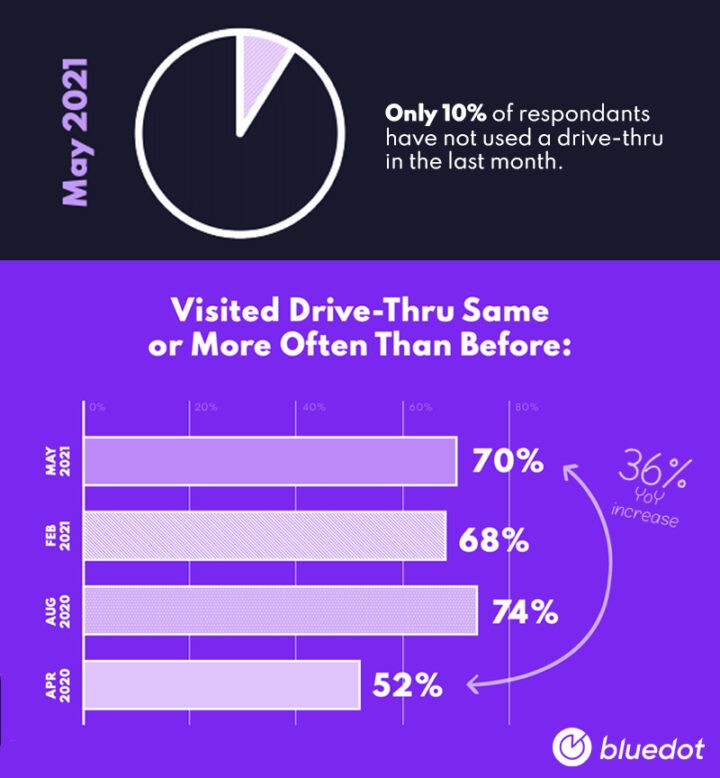

Consumer Visits to Drive-Thrus Remain Strong.

Customers are continuing to visit drive-thrus long after most COVID restrictions have been lifted. This pickup method's staying power can be a powerful tool contributing to higher customer lifetime values.

Both Accuracy and Drive-Thru Speed of Service Count

Customers use the drive-thru because they care about their order accuracy slightly more than the speed of service. When asked why customers visit drive-thrus 67% chose order accuracy, while 61% chose speed and wait times.

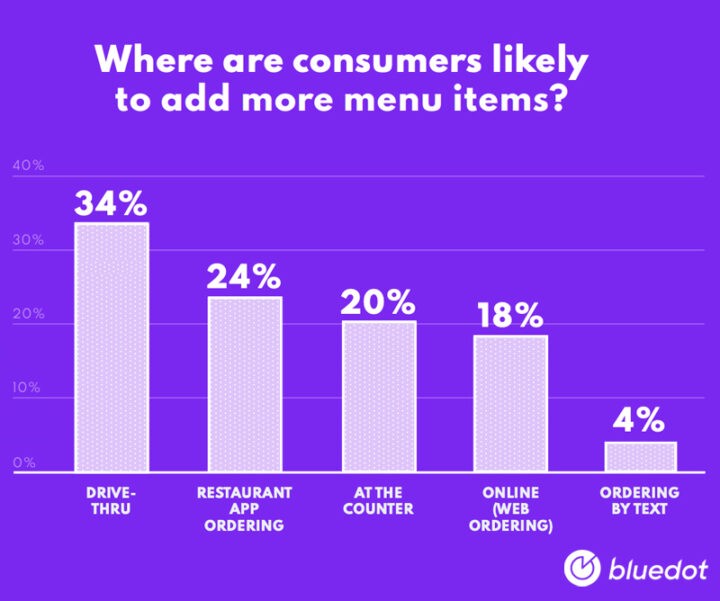

The Add-On Lane

Would you like fries with that? 34% of consumers ranked drive-thru as the most likely place they would add more menu items.

Personalization Wanted

Whether it's a menu board that displays their loyalty points, regular order, or greets them by name, customers want personalized dining experiences. 1 in 3 consumers stated that personalized deals & offers would keep them coming back to a specific drive-thru. McDonald's plans to enhance its current digital menu boards by offering personalized suggestions on deals via their mobile app, self-serve kiosks, and drive-thru.

Muffled Speaker Boxes Aren't Cutting It

Consume demand for modern menu boards is growing especially for confirming customers' orders.

Mobile-Only Lanes

When asked what consumers want in a restaurant experience, a designated drive-thru line for mobile is the #1 ask, far outranking other future restaurant innovations. 31% of respondents said that a dedicated drive-thru lane for mobile orders would keep them coming back.

Drive-Thru Grows Beyond Fast Food

As the differences between fast food and fast-casual continue to blur, 51% of consumers would visit fast-casual over fast food if they had a drive-thru.

Brands that accelerated investments in technology and logistics to deliver faster and more frictionless service during the pandemic are beginning to level the playing field, but now there’s a race to roll out restaurants of the future. It’s the next evolution of personalization, speed and convenience layered with a unique brand experience that will best position restaurants to win market share.

–Emil Davityan, CEO | Bluedot

Take a deeper dive into our consumer analysis for more than just drive-thru trends. Our State of What Feeds Us Volume 4 study examines consumer trends around mobile app usage, pickup preferences, and what the term "restaurant of the future” really means in terms of customer demand.

Are you choosing the best geofencing software? Check out our guide and free RFP template to make sure.